Member Newsletter:

Recent Member Newsletters can be found by clicking here.

Sign up for our Members Newsletter by clicking here.

Current Press Updates From Your Government:

Government of Canada, please click here.

Government of Ontario, please click here.

City of Toronto, please click here.

Additional Information:

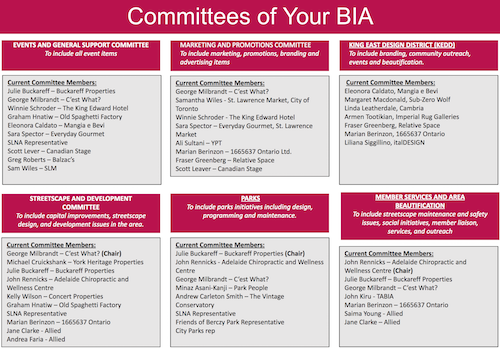

Volunteer on a BIA Committee

Here at your local Business Improvement Area we appreciate the time and effort of our volunteer committee members. These volunteers meet on an as needed basis, (typically once or twice a year) and make themselves available via email and phone when needed.

Committees include:

Events and General Support Committee

Marketing and Promotions Committee

King East Design District Committee

Streetscape and Development Committee

Parks Committee

Member Services and Area Beautification Committee

If you would like to volunteer with one of our committees, please email Executive Director Al Smith at alsmith@stlawrencemarketbia.ca.

Check your property monthly for graffiti

Graffiti has been and will continue to be an ongoing issue in our city. Here in Old Town Toronto your local BIA spends time weekly reporting graffiti on publicly owned assets, such as utility boxes, Canada Post boxes, parking meters etc. We also over this past year have invested in cleaning up to 65 graffitied Toronto Hydro poles per month. These actions/programs help lower the number of “tags” visible in our neighbourhood, helping to create a more welcome environment for all, but we cannot do it alone.

All businesses and property owners are encouraged to maintain their property on an ongoing basis in accordance with Chapter 485, which states “The owner or occupant of property shall maintain the property free of graffiti vandalism.” Failure to do so can result in the city serving a notice to comply. If the notice is not adhered to, the city can opt to do the work and add the cost to the property’s taxes. (Read the chapter for full explanation.)

Be proactive. Check your property monthly and clean off any graffiti in a timely fashion. Together we can help keep Old Town Toronto a welcoming area. Thank you for your ongoing efforts!

To report graffiti, please email the City of Toronto with the address and a photo at 311@toronto.ca.

Patio Heaters Fire Prevention

During the recent Fire Prevention Week, the Technical Standards & Safety Authority (TSSA), the Ontario Association of Fire Chiefs (OAFC) and the Canadian Propane Association partnered to educate the hospitality industry and the public about potential fire and carbon monoxide hazards associated with the improper use of patio heaters.

Please review this important press release and the guidelines you should post in your staff room.

REMINDER: Keep these units locked up outside at night to avoid theft. See Safety Guide for rules, regulations and additional storage information.

Am I a member?

Every business and commercial property owner within the boundaries of The St. Lawrence Market Business Improvement Area (BIA), also known at Old Town Toronto, are automatically members of our not-for-profit organization. To view a map of our boundaries, please click here now.